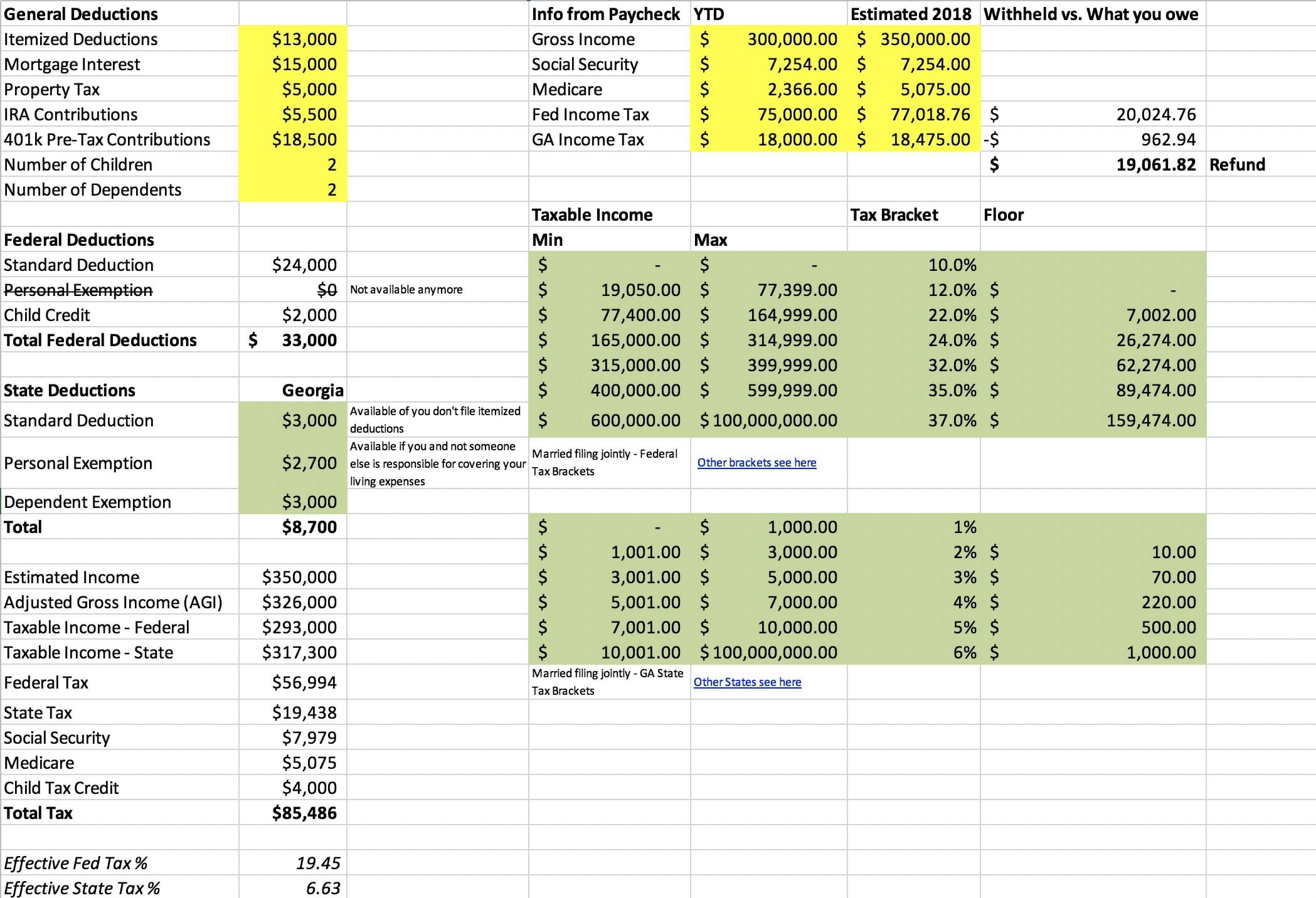

Calculate 2025 Tax Return - Calculating the federal income tax rate. Nerdwallet is a free tool to find you the best credit cards, cd rates, savings, checking accounts, scholarships, healthcare and airlines. Tax Calculator 2025 25 2025 Company Salaries, This tax return and refund estimator is for tax year 2025. Start here to maximize your rewards or minimize your.

Calculating the federal income tax rate. Nerdwallet is a free tool to find you the best credit cards, cd rates, savings, checking accounts, scholarships, healthcare and airlines.

Tax rates for the 2025 year of assessment Just One Lap, Nerdwallet is a free tool to find you the best credit cards, cd rates, savings, checking accounts, scholarships, healthcare and airlines. This tax return and refund estimator is for tax year 2025.

Refund Cycle Chart Online Refund Status, Use our tax return calculator to estimate your ato tax refund in seconds. The 2025 standard deductions and 2025 tax brackets have been added.

Maybe it's time to boost your emergency fund, pay down debt, or invest in your future.

2025 Tax Tables for Australia, Calculating the federal income tax rate. Use our simple 2023 income tax calculator for an idea of what your return will look like this year.

Calculate 2025 Tax Return. Use our simple 2023 income tax calculator for an idea of what your return will look like this year. Get a rough estimate of how much you’ll get back or what.

How to Calculate Federal Tax, 2025 income tax return for 2023. Sars tax refund calculator for 2025 work out how big your tax refund will be when you submit your return to sars

How to Calculate Payroll Taxes 2025 (stepbystep guide), If you're expecting a refund, consider how you can use it wisely. Canada income tax calculator 2023.

Get a quick, free estimate of your 2023 income tax refund or taxes owed using our income tax calculator.

This tax return and refund estimator is for tax year 2025.

IRS Refund Schedule 2025 When To Expect Your Tax Refund, What you can do with the calculator. If you need to access the.